[Devlog] Born from My Own Retirement Planning: Why I Built This Portfolio Analysis Tool

Date: June 14, 2025

Hello everyone,

As I began to seriously plan for my upcoming retirement, the first question on my mind wasn't where I would travel, but rather: "How can I build an investment portfolio that lets me sleep well at night?"

My goals were clear and practical: I needed an asset allocation that could provide stable passive income while keeping risk and volatility within an acceptable range.

And so, my journey began. I read numerous books on Modern Portfolio Theory and asset allocation, and I experimented with many financial tools and online platforms. But I gradually ran into a dilemma: they were either too simplistic, failing to meet my need for true global, cross-asset class diversification, or they were prohibitively expensive institutional terminals, far out of reach for an individual investor.

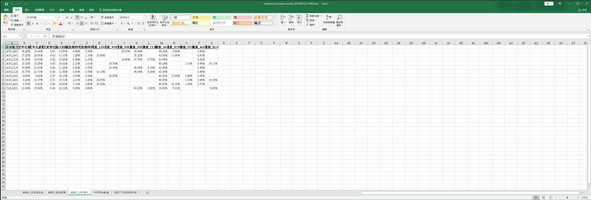

I found that no single tool could easily answer my core question: "If I choose 5 assets at a time from my personal pool of 20 global ETFs and stocks, what are their potential future performances and risks under various weighting schemes? And which combination best meets my criteria for 'low volatility' and 'high dividend yield'?"

After many fruitless searches, a new thought took hold—instead of continuing the search, why not build a tool myself that perfectly fits my needs?

This is how the "Investment Portfolio Simulator & Analysis Tool" came to be. It was born from a personal solution, tailor-made by a soon-to-be retiree for himself.

My Core Design Philosophy

Throughout the development process, I adhered to a few key principles:

- The User Must Be in Control: You, not the platform, decide the "stock pool" of candidates. You can include US tech ETFs, leading Taiwanese stocks, global bonds, or gold ETFs, achieving true customization.

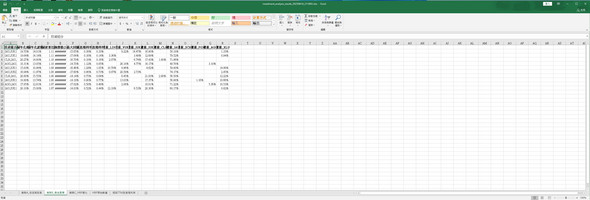

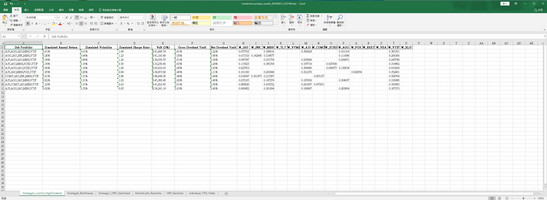

- Data-Driven, Not Gut-Driven: All decisions should be based on quantitative analysis. That's why I integrated Monte Carlo simulations to forecast future possibilities and the Hierarchical Risk Parity (HRP) model to optimize based on historical risk structures.

- Multiple Strategic Perspectives, Not a Single Answer: There is no "one right answer" in investing. I designed the tool to output results based on three distinct strategies:

- Strategy A (Low Volatility & High Dividend): Designed for conservative investors like myself, who prioritize risk management and cash flow above all else.

- Strategy B (Optimal Sharpe Ratio): For rational investors seeking the highest possible risk-adjusted return.

- Strategy C (HRP Optimization): A more modern approach to asset allocation. It doesn't chase the highest theoretical return but instead aims to distribute risk as evenly as possible across the entire portfolio, striving for the most robust and stable long-term performance.

Who Is This Tool For?

I built this tool for people like me:

- You are a sophisticated investor who takes your assets seriously.

- You are not satisfied with the "one-size-fits-all" advice common in the market.

- You believe in the power of data and quantitative analysis but may not be a professional algorithmic trader.

- You want a powerful tool to help you sandbox ideas and explore possibilities before making a decision.

This project was born from a personal need, and it has helped me immeasurably in planning my own retirement investment blueprint. Now, I've decided to share it, because I believe there are many others walking a similar path.

I hope this tool can offer some help and inspiration on your own investment journey. You are welcome to try it, and I look forward to hearing any feedback you may have.

Wishing you sound investments and a peaceful life.

Disclaimer: All analysis results from this tool are based on historical data and statistical models. They are intended for academic, research, and personal decision-support purposes only and do not constitute any form of investment advice. Investing involves risk; please use your own independent judgment and assume full responsibility for your decisions.

Files

Get Investment Portfolio Simulator – ETF Strategy Backtest Tool for HRP, Sharpe, Dividend Yield

Investment Portfolio Simulator – ETF Strategy Backtest Tool for HRP, Sharpe, Dividend Yield

An advanced desktop tool for portfolio analysis using Monte Carlo & HRP models.

| Status | Released |

| Category | Tool |

| Author | parn00658303 |

| Genre | Simulation, Strategy |

| Tags | finance, hrp, investment, monte-carlo, portfolio, quantitative-finance, tool, windows |

More posts

- Current Status & Future HorizonsJun 15, 2025

Leave a comment

Log in with itch.io to leave a comment.